Financial Analyst Report - A2M FY23 Result and Forecast Changes

FY23 Result and Changes to Forecasts:

A2 Milk (A2M) has reported FY23 underlying NPAT exceeding our expectations, reaching NZ$155.6 million. Key highlights from the results include:

Operating Results:

- Revenue of NZ$1,593 million, up +10% YoY (versus BPe NZ$1,587 million).

- EBITDA of NZ$219.3 million, up +12% YoY (versus BPe NZ$215.4 million).

- EBITDA ex-MVM (Marketing and Advertising) at NZ$245.8 million (versus BPe NZ$234.3 million).

- Underlying NPAT of NZ$155.6 million, up +27% YoY (versus BPe $147.5 million).

Infant Formula Drivers:

- China distribution points decreased -2% YoY to 25,900 and were down -3% from the previous half.

- China direct Infant Milk Formula (IMF) sales reached NZ$945.6 million (+36% YoY) and constituted 90% of total 2H23 IMF sales (compared to 67% in FY22 and 80% at 1H23).

- Marketing expenditure amounted to NZ$260.2 million (versus BPe of NZ$274.9 million), showing a +14% YoY increase.

Cashflow and Balance Sheet:

- Lease-adjusted operating cashflow of NZ$107.7 million, compared to a NZ$199.7 million inflow in FY23 (and BPe of NZ$102.5 million). This reflects a NZ$103.1 million working capital investment ahead of China regulatory changes.

- Net cash at the end of the period stood at NZ$700.7 million (BPe NZ$695.2 million), compared to NZ$763.0 million in FY22, impacted by a NZ$149.1 million share buyback.

FY24e Outlook:

- A2M expects low single-digit revenue growth in FY24e with EBITDA margins largely consistent with FY24e levels, accompanied by higher levels of cash conversion.

- The company has retained its medium-term target EBITDA in the "teens," although it states that reaching the "low-to-mid 20s" is unlikely in the foreseeable future.

Changes to Forecasts:

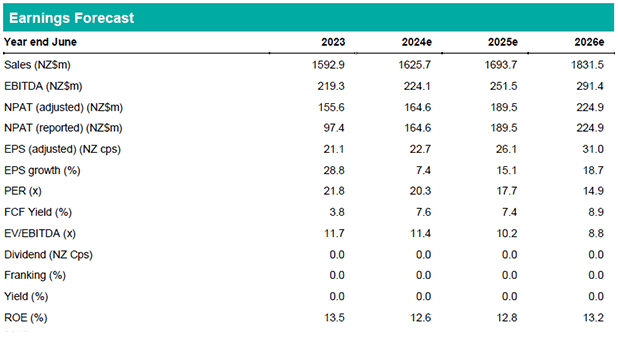

Following the result, we have downgraded our NPAT forecasts by -6% in FY24e and FY25e. Our target price has been revised to A$4.85 per share (previously A$5.70 per share).

Investment View - Hold Rating Unchanged:

We anticipate that 1H24 will pose challenges due to the China label transition and potential disruptions as brands exit the market (approximately 35% are yet to receive SAMR approval). However, A2M has managed to gain market share in all key measures within a declining market. The company is well-positioned to benefit from brand consolidation in the Chinese market, stabilizing birth rates, and the return of overseas travelers and students to Australia.