Financial Analyst Report - Outperformance in Furniture & Homewares Category

Outperforming Furniture & Homewares Category:

In our latest analysis of the Furniture & Homewares (F&H) category trends, we reevaluate our forecasts and valuation for TPW (The Company). While the F&H category, encompassing both online and offline segments, has witnessed a gradual decline since mid-1Q2023, the online channel, particularly web traffic, has displayed a return to growth. Notably, there have been consecutive positive trends on a year-over-year basis through June and July (month to-date). TPW has notably outperformed both the overall online market growth and peers like Adairs over the past two months. This outperformance is partially attributed to favorable comparisons with the softer trading during the onset of the monetary policy tightening cycle about 12 months ago. We anticipate this trend to persist, potentially leading to upgrades in consensus expectations.

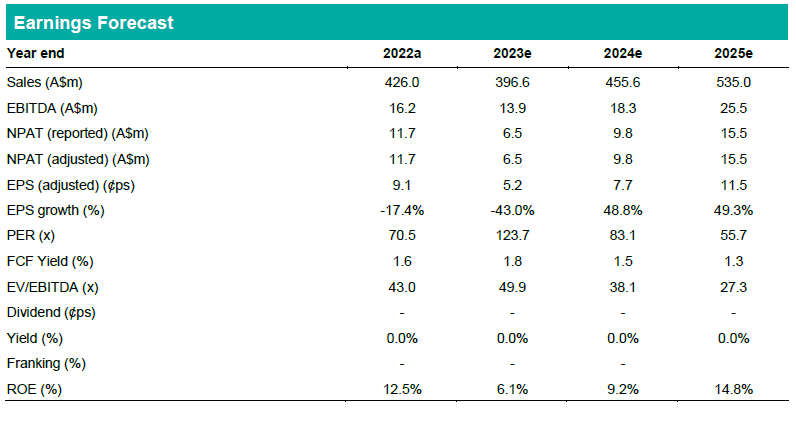

Marginal Upgrades in FY24/25:

While our estimates for FY23 remain unchanged, we have made marginal adjustments to our revenue forecasts for FY24/25 to account for TPW's web traffic performance in July (month to-date). Despite maintaining caution regarding the short-term outlook and anticipating further reduction in Furniture & Homewares category spending, we acknowledge TPW's resilience and stronger start to FY24, which has driven an uplift in 1H24 revenue. Our EBITDA margin assumptions remain unaltered (4.0% and 4.8% for FY24/FY25) as we await further guidance from the company in the August FY result. We believe TPW is well-positioned to achieve revenue growth exceeding $1 billion over the next five years, with higher margins than pre-COVID levels.

Investment View: PT Up 36% to $6.40, Maintain HOLD:

Our price target (PT) has been increased by 36% to $6.40/share (previously $4.70/share). This revision is driven by forward earnings inclusion in the Discounted Cash Flow (DCF) model up to FY33e and relative valuation (based on FY25e). Additionally, we have raised our target multiple to 22x EV/EBITDA (previously 19x) to align with the re-rating observed in the global peer group average EV/EBITDA (based on CY23/24). Over the past 12 months, the average group multiple has expanded by 16%. While we acknowledge TPW's long-term potential and execution capabilities surpassing peers, our updated PT of $6.40 still offers a total expected return of <15%. Therefore, we maintain our HOLD rating.