Moving from turnaround to ‘growth’ phase

We are initiating coverage of Retail Food Group (RFG) with a Buy rating and a Price Target of $0.13 per share. RFG stands as Australia's largest multi-brand retail food franchise owner in the Quick Service Restaurants (QSR) and Coffee sectors. The company franchises and operates an array of stores under mass brands such as Donut King & Gloria Jeans, as well as mid-market brands like Crust Pizza, spanning regions including ANZ, the US, and EMEA. With a forward-looking FY24e P/E ratio of 4.6x (Bloomberg consensus), RFG's valuation appears attractive, particularly considering the significant transformation it has undergone over the past five years, transitioning from a turnaround phase into a growth phase.

Capital Light Opportunities for Earnings Growth:

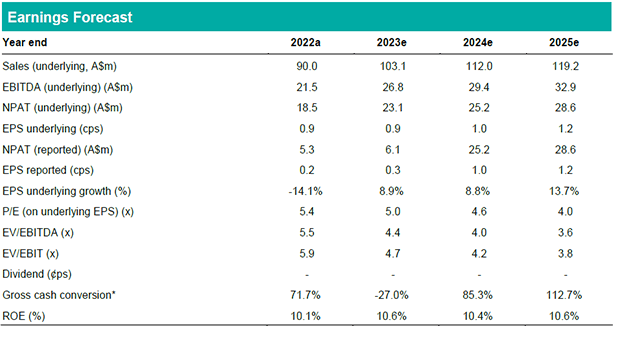

While RFG anticipates net growth in its overall store count in FY24, we see additional growth avenues through initiatives such as incremental revenues from QSR stores and the planned expansion of organic growth in the US market. Guided by the current management team and their well-structured progression plan (Matthew Marshall appointed CEO), these capital-light opportunities are expected to accelerate earnings growth in the medium to long term, while enhancing free cash flow conversion. Our projections indicate an 11% p.a. growth in Underlying EBITDA over the next five years, driven by these strategic initiatives. Following its recent trading update, RFG anticipates delivering results toward the lower end of the $26-29 million Underlying EBITDA guidance for FY23e, attributing this performance to macroeconomic headwinds and the challenging year-over-year comparisons in certain major categories.

Investment View: PT $0.13, Initiate with BUY:

We commence coverage with a Buy rating and a Price Target of $0.13, based on a blend of P/E (utilizing a target multiple of 10.5x on a blended FY24/25e basis) and DCF (with a WACC of approximately 12% and terminal growth rate of around 3%) methodologies. In the current environment characterized by a slower pace of consumer spending, we anticipate RFG's resilience, primarily due to its lower average transaction value (ATV) of below $9 (excluding Pizza). This resilience is underscored by our observation in the year-to-date update, where all RFG brands experienced growth in ATVs. Furthermore, we identify opportunities to enhance pricing. We perceive lower execution risk in the store rollout, supported by a robust management team and increasing stakeholder backing following the resolution of ACCC proceedings.