Financial Analyst Report - Strong Q4 Results and FY23 Guidance Beat for MAD

Strong Q4 Results and FY23 Revenue Guidance Beat:

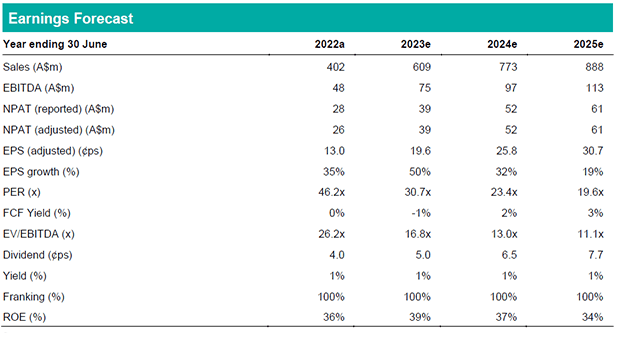

In its latest financial report, MAD marked a significant milestone by delivering its 12th consecutive quarter of revenue growth. The strong performance in the final quarter, with revenue reaching $173 million, resulted in FY23 revenue amounting to $609 million, aligning with our expectations. Notably, MAD had upgraded its full-year guidance twice to exceed $580 million. This robust quarter's strength stemmed from growth in MAD's Australian operations, fueled by robust demand for core mechanical services and new vertical offerings. Furthermore, MAD expanded its presence in North America, penetrating new regions in the US and experiencing headcount growth in Canada. Q4 EBITDA reached $23.5 million, surpassing our $20.1 million projection, partially attributed to the timing of contracted work scopes. For FY23, EBITDA amounted to $75.0 million, ahead of our estimate of $71.6 million. The quarter-end net debt, excluding leases, stood at $42.7 million, consistent with the previous quarter. The EPS adjustments in this report reflect an upward revision in revenue growth assumptions, a reduction in EBITDA margin assumptions, and higher depreciation expenses due to increased capital expenditure over FY23-25, with changes as follows: FY23 +3%; FY24 +7%; and FY25 +15%.

All Eyes on FY24 Revenue & NPAT Guidance:

With MAD significantly surpassing its twice-upgraded FY23 revenue guidance, investors are now focused on management's guidance for FY24 financial performance. The strong exit-rate of FY23 financial performance, along with positive momentum in Australian and North American operations, is expected to carry forward into FY24. Our outlook indicates EPS growth of 31.6% in FY24, compared to 50.3% (BPe) in FY23. Given the current share price, we believe this EPS growth outlook is adequately priced-in.

Investment Thesis: Hold; TP$6.10/sh (prev. $5.10):

Our MAD earnings outlook is supported by the ongoing expansion of the company's core and new service offerings across mature Australian operations and growth markets in the United States and Canadian mining and energy sectors. We recognize MAD's valuation premium of 107% (FY24 EV / EBITDA) compared to peers in the Mining Services sector, which justifies our high-growth earnings outlook. Our Hold recommendation reflects our belief that MAD is fairly valued at its current share price.