Financial Analyst Report - Johns Lyng Group (JLG)

FY23 Earnings Guidance and Overview:

Johns Lyng Group (JLG) has recently issued its earnings guidance for FY23. The updated forecast indicates a substantial boost in headline revenue for FY23, excluding the soon-to-be-exited Commercial Construction division, with an upgrade of approximately $110 million, reaching $1.19 billion. This reflects a remarkable 10.2% increase over the February 2023 guidance and, more notably, a growth rate of 47.7% compared to FY22.

CAT Segment Highlights:

Within this guidance, JLG now expects its Catastrophe (CAT) segment to achieve revenue of $350.5 million (previously estimated at $240.5 million in February 2023) and EBITDA of $41.0 million (formerly $29.0 million). An annualized projection, based on the CAT work completed from March to June 2023, suggests a substantial CAT run-rate for JLG. It's worth noting that JLG secured $78 million in Hurricane Ian-related work in the US, and its engagement with local government entities is progressing towards securing ongoing contracts with State governments such as Queensland and Victoria.

BAU Segment Analysis:

JLG has reconfirmed its Business As Usual (BAU) revenue forecast at $837.6 million (versus a Bell Potter estimate of $847.5 million). However, the underlying BAU EBITDA of $92.2 million (excluding a $2.3 million bad debt) fell slightly short of our $99.3 million estimate. We believe that the relatively early stage of JLG's US business, particularly front-loading start-up costs for establishing JLG's 'full-service' proposition, has primarily driven the majority of margin compression experienced in the second half of 2023, showing a decrease of 90 basis points (HOH) to 10.5%.

Investment View - Downgrade to Hold:

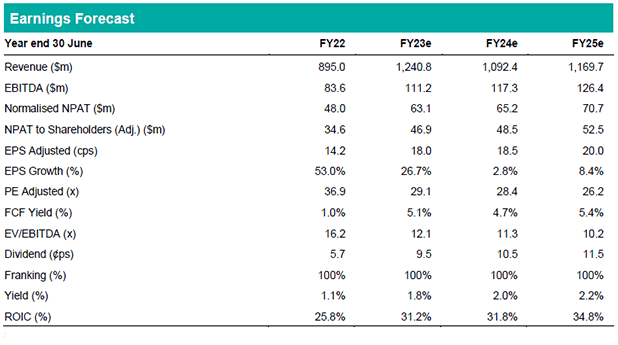

Our revised earnings per share (EPS) forecasts are as follows: +2% in FY23, -9% in FY24, and -8% in FY25. Although JLG is still expected to achieve FY23 BAU revenue growth of approximately 30% year-on-year (with organic growth ranging from 12-14%), we believe that the company is in the early stages of cycling an elevated period of property claims growth, averaging around 10% per annum since 2020. As a result, we maintain a Hold recommendation based on the anticipation of a softer domestic demand outlook for JLG, particularly with the El Niño weather phenomenon approaching, historically associated with falling property claims values. Nevertheless, key offsetting factors include JLG's execution in the US and its potential to leverage domestic insurance relationships, along with the company's ability to diversify revenue exposure to weather events and accelerate market share growth in the US through potential mergers and acquisitions (M&A).