Financial Analyst Report - Fortescue Metals Group (FMG)

Iron Ore Price Outlook:

In light of the unexpectedly robust iron ore prices, we have conducted a comprehensive review of our earnings forecasts for Fortescue Metals Group (FMG). This assessment has led us to increase our forecasts for FY23 by 4% on a marked-to-market basis. We have also chosen to tighten our price realization discounts due to strong market demand for mid-grade iron ore products and the increasing contribution from Iron Bridge, a project focused on producing high-grade magnetite concentrate. The surge in seaborne iron ore prices can be attributed to various factors, including Chinese Government stimulus measures, such as interest rate cuts and relaxed housing policies. Nonetheless, it's essential to acknowledge that downstream demand remains sluggish, contributing to mixed market sentiment. Given these dynamics, we have raised our short-term iron ore price assumptions while keeping our medium and long-term price projections unchanged. These latter forecasts continue to reflect a gradual decline, reaching US$90/t nominal (US$82/t real) in FY25.

Incorporating Iron Bridge:

Furthermore, we have reduced the risk adjustment discount applied to the Iron Bridge Magnetite Project, in which FMG holds a 69% ownership stake. The project commenced production in the June 2023 quarter and is currently ramping up production to reach a nameplate run-rate of approximately 22 million metric tons per annum, with a grade of around 67% Fe in magnetite concentrate. As this high-grade production ramps up, it is expected to provide FMG with valuable marketing and strategic opportunities, enabling the optimization of the entire iron ore product range.

Investment Thesis - Maintain Sell with TP$15.16/sh (Previously TP$14.45/sh):

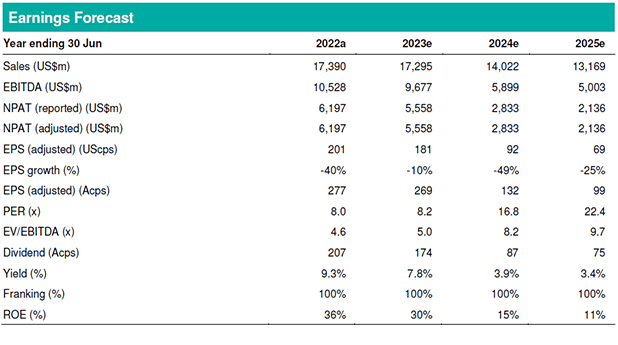

The revisions to our earnings forecasts are as follows: FY23 +16%, FY24 +1%, FY25 +0%. Our NPV-based valuation has increased by 5% to $15.16/share due to the higher FY23 iron ore price and a reduced risk valuation for Iron Bridge. Despite FMG's operations consistently exceeding expectations, our Sell recommendation remains unchanged. We anticipate a decline in iron ore prices, earnings, and dividends, coupled with uncertainties surrounding capital allocation and investment returns, notably concerning the FFI and Belinga projects in Gabon. As such, we see limited upside potential from the current share price.