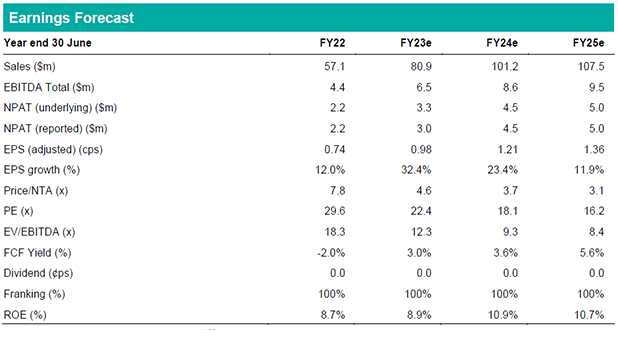

Financial Analyst Report - EGL's Strong FY23e Earnings Growth

EGL on Track for 50% Earnings Growth in FY23e:

EGL has provided a trading update for FY23e that has surpassed Bell Potter forecasts. The company anticipates achieving FY23e underlying EBITDA of approximately $6.6 million, indicating a remarkable year-on-year earnings growth of +50%. This projection outperforms its previous guidance of $5.9 million (with BPe at $6.0 million). EGL's 4Q23 work rate, characterized as "particularly pleasing," exhibited robust performance in ongoing services and projects, with minimal contribution from the recently acquired Airtight in May 2023.

TAPC and EGL Energy Taking the Lead:

In our analysis, EGL's trading update and strong exit rate in 4Q23 suggest that most, if not all, of the company's segments are surpassing our expectations. Nevertheless, it is our belief that management's commentary aligns most closely with significant contributions from TAPC. EGL recently experienced an upturn in service level revenues at TAPC, along with ongoing air emissions contracts involving Hastings Technology Metals ($17.8 million) and Covalent Lithium ($5.2 million) refineries. Looking ahead to FY24e, we anticipate emerging pipeline opportunities, with five major battery minerals processing and refinery projects slated for production between 2025-26.

Moreover, we expect improved margins from EGL Energy, as costs for materials like steel, freight, and valve prices have normalized compared to 2022 highs. EGL Energy may also see another robust FY24e following the exit of several key regional competitors.

Investment View: Maintain Buy Recommendation:

We have adjusted our EPS estimates by 8%, 3%, and 1% for FY23-25e. Given the project-oriented nature of two of EGL's segments, our primary uncertainty at this stage revolves around whether a portion of the company's larger project pipeline was accelerated into FY23. As we await further visibility at the FY23 result, EGL remains one of our top picks, with potential earnings and/or news flow catalysts anticipated over the next 12 months. These catalysts include: (1) PFAS separation plant sales; (2) conversion of a ~$115 million waste pipeline; and (3) the potential for additional air pollution control projects in the battery minerals sector.