Altium Financial Analyst Report - Forecast Revision and Investment View

Executive Summary:

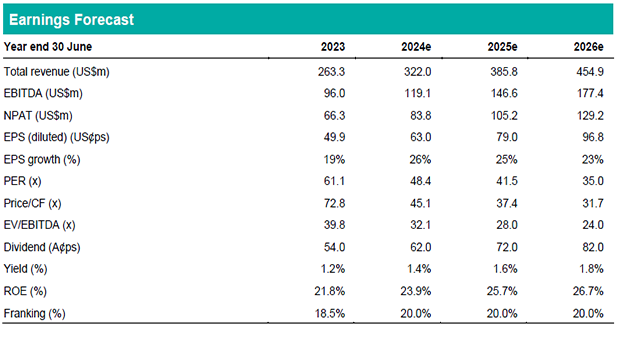

In light of Altium's FY23 financial results released last month, we have conducted a comprehensive review of our forecasts. While the overall adjustments are relatively modest, they reflect significant insights into Altium's performance. Key changes include a 1% increase in revenue projections primarily attributed to higher design software revenue, partially offset by lower cloud platform revenue. Additionally, we anticipate a 1% growth in Net Profit After Tax (NPAT) driven by the revised revenue projections, with no modifications to our margin forecasts. However, we observe a minimal impact on our Earnings Per Share (EPS) forecasts, mainly due to an increase in our estimated fully diluted shares, which largely offsets the NPAT upgrades.

Our revised forecast for FY24 sets the revenue target at US$322.0 million, slightly higher than the previous estimate of US$320.4 million, positioning it within the guidance range of US$315-325 million, albeit closer to the upper end. This aligns our design software and cloud platform revenue forecasts of US$252.6 million and US$69.4 million, respectively, with the company's guidance of US$250-255 million for design software and US$65-70 million for cloud platform revenue. It's important to note that our EBITDA margin forecast remains unchanged at 37.0%, at the upper boundary of the 35-37% range. In addition, we have adjusted our FY26 revenue projection to US$454.9 million, up from US$450.5 million, although this figure still falls short of Altium's aspirational target of US$500 million.

Investment View: Price Target Increased by 10% to $44.00, Maintain HOLD Recommendation

Our investment analysis involves several adjustments to valuation metrics. Specifically, we have revised the price-to-earnings (PE) ratio and enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) multiples upward from 45x and 25x to 50x and 27.5x, respectively. Furthermore, we have reduced the weighted average cost of capital (WACC) used in the discounted cash flow (DCF) analysis from 9.4% to 9.0%. These changes reflect our confidence in the higher quality of Altium's design software revenue, which exhibits stickiness and recurring characteristics.

Consequently, we have revised our Price Target (PT) upwards by 10% to $44.00 per share. Despite this increase, our PT still represents a modest discount to the current share price, leading us to maintain our HOLD recommendation. Notably, Altium's FY24 PE ratio of approximately 48x places it at fair value compared to its peers. While Technology One trades at a PE ratio of around 42x and WiseTech Global at approximately 82x, it's essential to acknowledge the challenges in making direct comparisons due to differing accounting practices. Altium's transition to Software as a Service (SaaS) is still in its early stages, and we anticipate that Altium and Technology One should trade at similar multiples, considering the benefits and challenges associated with being a global software company in transition.