Ekati Diamond Mine - An Overview

BDM's primary asset is the Ekati Diamond Mine, situated in Canada's Northwest Territories, a renowned top-tier operation in the global diamond mining industry. Ekati proudly ranks among the top 10 diamond mines globally in terms of volume. In the year 2022, it achieved notable sales of 4.2 million carats, generating substantial revenues of US$494 million and an impressive Adjusted EBITDA of US$200 million. The mine's lineage traces back to its development by BHP Ltd (ASX: BHP, not rated), and it commenced production in 1998. Ekati's current configuration encompasses both an open pit and an underground mine, both contributing to a central processing facility. Furthermore, there are plans for the development of an additional open pit mine, which is expected to extend the mine's operational life until 2028. Notably, BDM successfully completed the acquisition of Ekati for US$136 million in early July 2023.

Value Opportunities - Expanding Horizons and Downstream Ventures

Ekati harbors significant potential for value enhancement through various avenues. Firstly, the current operations are poised to extend their depths, thereby mitigating operational risks and extending the mine's lifespan. Secondly, there exists the possibility of expanding the footprint of the new open pit, potentially increasing production output over an extended horizon. The exploration endeavors across Ekati's properties are well-advanced, with only 11 out of the identified 177 kimberlite pipes having been developed to date. Additionally, BDM envisions optimizing its rough diamond sales processes through strategic partnerships and downstream processing. It's worth highlighting that BDM's management team brings extensive expertise garnered from their tenure at major diamond producers, including De Beers and Rio Tinto (Diavik).

Investment Outlook - A Compelling Buy Opportunity, Target Price of $0.50 per Share

Our investment perspective is strongly positive, grounded in the belief that experienced management can further unlock the potential value of an already distinguished top-10 global diamond mine. Ekati holds a pivotal position within the thriving global luxury goods value chain. Currently, Russia and African nations collectively supply approximately 80% of the world's diamonds. As consumer preferences are increasingly influenced by ESG considerations, BDM's downstream associations can capitalize on the Canadian provenance of Ekati diamonds, aligning with evolving market dynamics.

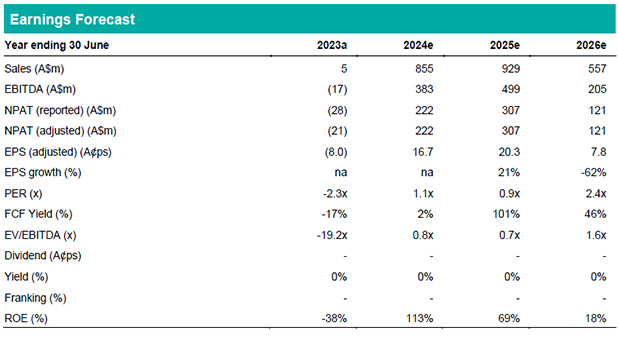

Following the Ekati acquisition and the concurrent capital raise, BDM's pro forma debt (excluding leases) stands at approximately A$150 million, while its cash position is robust at A$132 million. BDM is adequately capitalized to support its current operational outlook. Importantly, BDM is trading at a highly favorable FY24 EV/EBITDA multiple of only 0.8x, representing a substantial discount to our comprehensive sum-of-the-parts valuation.